For nearly a decade, the federal government took a whole lot of dollars every month out of the paychecks of a Florida lady named Michelle to recoup previous pupil loans that had been unpaid and overdue. The method, known as garnishment, is authorized, and the U.S. Division of Training can order it for somebody's wages, tax returns and Social Safety to power reimbursement on defaulted loans.

Michelle's garnishment started in 2008. As a public college trainer in Orlando, who requested to be recognized by her first title solely as a result of this story entails her private funds, she struggled for the following eight or 9 years to make ends meet whereas supporting her two youngsters.

"I virtually misplaced my home and the whole lot over this as a result of I simply could not afford it," she mentioned. And with roughly $800 per 30 days immediately gone, Michelle recalled at occasions going through unattainable selections daily: "I've obtained to contemplate, 'Will we get this meal or will we hold the lights on? Which is extra vital proper now?'"

After the garnishment interval ended, Michelle believed that her pupil money owed had been paid in full. However, this previous spring, she began receiving notices a couple of totally different mortgage, which she borrowed by the now-defunct Perkins Mortgage Program whereas pursuing an undergraduate diploma on the College of Florida.

This system provided low-interest federal loans to undergraduate and graduate college students with "distinctive monetary want," in accordance with the Division of Training, and is now being phased out since formally closing in September 2017. Michelle utilized for mortgage forgiveness by the Perkins program after graduating from the College of Florida in 1997, and later glad the educating service necessities to get it.

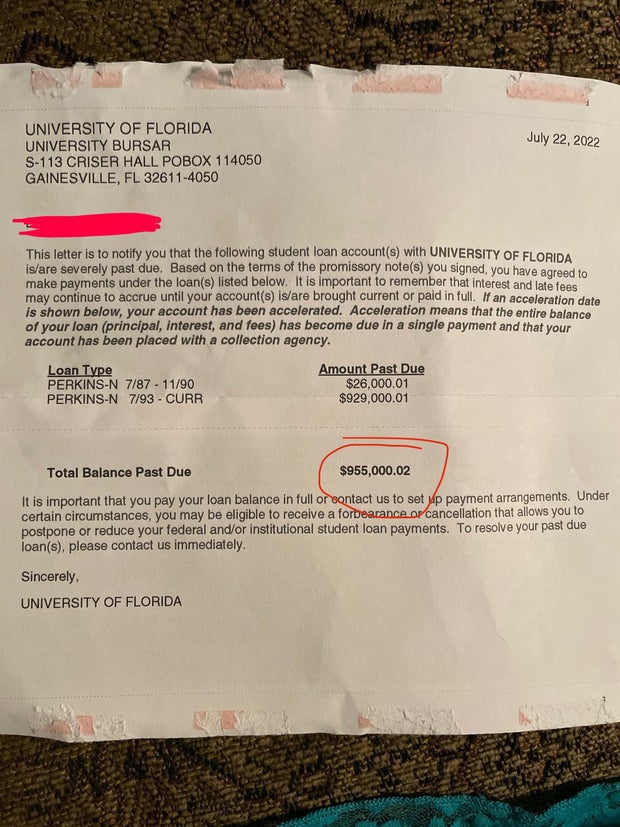

So, when Michelle opened a letter from her alma mater in July suggesting that her Perkins mortgage repayments had been "severely overdue," she was surprised. Much more confounding than the invoice itself was the quantity it mentioned she nonetheless owed the college: $955,000.02.

"I truly went into despair. I went into hiding. I did not know how you can make sense of it as a result of it was so way back," mentioned Michelle. "So now, I am like, I am about to retire and I am about to lose the whole lot."

Michelle turned out to be unsuitable. Thanks largely to an web stranger with a long time of experience who eagerly provided to assist kind by the coed mortgage debacle, her state of affairs modified virtually in a single day.

Michelle's daughter posted the letter to Reddit — a website that Michelle mentioned she had visited "perhaps twice" in her life earlier than — in a bit devoted to discussions about pupil loans. The location's customers shortly tagged one member — Betsy Mayotte, the president and founding father of a corporation known as The Institute of Pupil Mortgage Advisors, which offers a variety of free providers to debtors like Michelle.

Mayotte is an everyday within the website's r/StudentLoans subreddit, the place folks share private experiences and ideas as they navigate daunting reimbursement schedules amid altering debt aid insurance policies below the Biden Administration, and often makes use of it to attach with individuals who want recommendation about their loans. In a touch upon the unique submit from Michelle's daughter, one other consumer calls Mayotte the "GOAT," which stands for biggest of all time.

Mayotte, having labored earlier than with Perkins mortgage debtors who had been blindsided by sudden payments, stepped in as a liaison between Michelle and the College of Florida. The unique quantity was shortly decided to be a mistake. A spokesperson on the College of Florida attributed the error to a technical difficulty at ECSI, an organization that universities rent to behave as a mortgage servicer for former college students repaying balances by the Perkins program.

Whereas the college mentioned in an announcement that it couldn't touch upon Michelle's case particularly, citing information safety legal guidelines for college kids, the college famous that "no pupil on the College of Florida has ever owed" almost $1 million in pupil loans.

"Nevertheless, in July, the College of Florida discovered that the pc system utilized by the corporate that handles billing for the college issued statements with misguided quantities to debtors for a lot of faculties, together with UF," the assertion continued. A college spokesperson later mentioned ECSI deliberate to difficulty new statements "reflecting the right balances" inside every week of the error coming to gentle.

A spokesperson at ECSI confirmed the calculation difficulty and acknowledged in an announcement that the corporate "despatched letters to a small variety of debtors reflecting incorrect quantities owed on their loans" over the summer season.

"These letters had been promptly corrected and we apologize for any inconvenience this may increasingly have brought on," the spokesperson mentioned.

By the top of August, Michelle had obtained not less than one in every of a number of amended statements that may in the end come by mail from the College of Florida. The brand new stability nonetheless ran fairly excessive, about $8,000, and whereas Michelle mentioned she "felt higher, after all, as a result of that wasn't one million," she additionally suspected the revised quantity, which didn't match the stability mirrored in her on-line account, was incorrect.

After graduating along with her bachelor's diploma, Michelle had utilized for mortgage cancellation by a educating program provided to Perkins mortgage recipients. It promised to cancel a portion of the borrower's mortgage for each tutorial 12 months spent educating in sure faculties, or sure topic areas. For instance, somebody who taught in a college serving college students from low-income households, or taught particular schooling, math, science or overseas language lessons could be eligible for full mortgage forgiveness.

Michelle fulfilled the necessities in varied educating positions held over the course of 5 years. She submitted the information crucial to verify her eligibility for aid below the Perkins program pointers, and assumed the mortgage was forgiven. However, when Mayotte once more reached out to the college with questions on Michelle's up to date stability, she was instructed that Michelle's information by no means arrived.

"They mentioned they by no means obtained it," mentioned Mayotte. She famous that, in her expertise, miscommunication is widespread between Perkins mortgage debtors and their mortgage servicers, regardless of firm insurance policies that technically require mortgage servicers to ship debtors month-to-month notifications about their payments, particularly when they're overdue. In contrast to different federal pupil loans which might be managed by distributors or servicers affiliated with the Division of Training, Perkins mortgage servicers have traditionally been the colleges themselves, which then outsource mortgage servicing duties to a 3rd social gathering.

"I see on a regular basis, those that say, 'I have never had a invoice for my Perkins mortgage in 10 years, 20 years,'" mentioned Mayotte. "It makes it actually tough for the borrower. You already know, numerous occasions it is a legit invoice. But when it is not, what client retains information for 20 years to have the ability to push again on that?"

ECSI didn't grow to be a mortgage servicer for the College of Florida till the early 2000s, years after Michelle submitted her forgiveness paperwork to the college, and the corporate spokesperson mentioned it "had no involvement" within the record-keeping course of that decided whether or not or not she was granted aid.

"Nonetheless, we had been blissful to help the establishment with the problems that they had with this borrower and rectify the mortgage forgiveness," the spokesperson mentioned.

Michelle, "fortunately," per Mayotte, was in a position to show her eligibility for retroactive aid by the Perkins mortgage educating program. Her remaining stability: $408, which, she mentioned, was paid in full as of two weeks in the past.

"The one phrase I had was amen once I obtained that letter," Michelle mentioned. "I could not course of it utterly. I used to be simply grateful."

Though Michelle's exorbitant pupil mortgage stability was a mistake, Mayotte mentioned she has labored with a few purchasers earlier than who actually do owe near $1 million for cash borrowed to go to highschool.

A latest report revealed by the Training Information Initiative factors to the continued pupil debt disaster within the U.S., which has confirmed tough to treatment regardless of President Biden's promised mortgage forgiveness plan — now on maintain, per court docket order, and doubtlessly headed to the Supreme Courtroom. Pupil debt at the moment totals $1.745 trillion nationwide, in accordance with the report, which locations the typical federal mortgage debt stability at slightly below $38,000. However, with Biden's forgiveness plan stalled, the administration not too long ago introduced that it's extending the pause on pupil debt repayments till June of subsequent 12 months.

"Training, when financed by pupil loans, doesn't dwell as much as its mantra because the 'nice equalizer,'" mentioned Michelle in an electronic mail, including that debtors, notably those that go on to work within the public sector, usually "develop previous with the burdens of pupil loans and are typically by no means, ever absolutely in a position to make future plans, to improve life-style, to save lots of, to speculate, or retire on time. The pay is usually too low — paycheck to paycheck — and the life cycle of loans final solely too lengthy."