Greater than 10 million Australian taxpayers will obtain a further $420 tax minimize as a part of a set of Federal Funds measures aimed to lowering the price of dwelling.

From July 1, these incomes as much as $126,000 will obtain a one-off tax offset of $420.

This one-off cost of $420 will likely be mixed with the low- and middle-income tax offset (LMITO), which means eligible earners will obtain as much as $1500 again for single-income households or as much as $3000 again for a dual-income family.

WINNERS AND LOSERS:Who will get probably the most from election Funds

$250 PAYMENTS:Who's eligible?

PROPERTY SCHEME EXPANDED:Extra locations for homebuying program

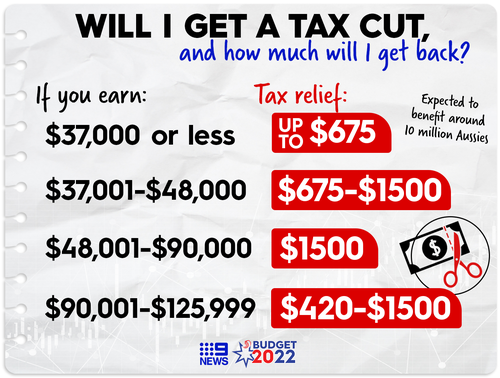

Will I get a tax minimize? How a lot will I get again?

Your taxable revenue | How a lot you will get again | What number of Aussies will profit? |

As much as $37,000 a 12 months | As much as $675 | 1.8 million |

$37,001 to $48,000 | $675 to $1500 | 1.6 million |

$48,001 to $90,000 | $1,500 | 4.8 million |

$90,001 to $125,999 | $420 to $1500 | 1.9 million |

Taxpayers who earn $126,000 a 12 months or extra won't obtain the $420 offset.

Treasurer Josh Frydenberg stated the offset was a short lived method of serving to Australians most weak to the prices of inflation.

“The Authorities is introducing a brand new momentary, focused and accountable value of dwelling package deal to take the strain off family budgets,” Mr Frydenberg stated.

“People already receiving the low- and middle-income tax offset will now obtain as much as $1500 and couples as much as $3000 from 1 July this 12 months.

“This measure comes on prime of the $40 billion in tax reduction already supplied by our Authorities for the reason that begin of the pandemic. Below the Coalition taxes for hard-working Australians will all the time be decrease.”

The $420 tax offset is predicted to value the Federal Authorities some $4.1 billion by way of to 2023-2024.

TWO-MINUTE GUIDE:The important thing Federal Funds figures

TRADIE CASH SPLASH:Cash for apprentices, small companies

CLIMATE CHANGE:What the Funds is doing for the atmosphere

A household instance

Steve and Lauren are a full-time working couple who stay collectively in Sydney.

Steve is a highschool instructor incomes $87,000 a 12 months and Lauren works for a non-profit authorities organisation incomes $60,000 a 12 months.

Each Steve and Lauren fall into probably the most populous tax bracket of between $48,001 and $90,000 a 12 months.

Below the LMITO, each Steve and Lauren will obtain $1080 in tax again.

However now with the extra $420 cost, each will obtain $1500 again or $3000 as a family.

After they lodge their return, the pair can pay $840 much less tax than they'd have final 12 months.

READ MORE:What's within the Funds for ladies?

MEET THE SAUNDERS:How a hypothetical household will profit